Cross-Utilisation of Credits – Input Tax Credit | GST in India

This blog delves into the intricacies of cross utilization of credits and input tax credit in the context of Goods and Services Tax (GST) in India. Understanding and effectively utilizing tax credits is essential for businesses to optimize their financial operations and stay compliant with GST regulations.

By unraveling the complexities surrounding cross utilization of ITC under GST India, we aim to empower businesses with the knowledge and insights necessary to leverage these provisions to their advantage. Whether you are a business owner, tax professional, or simply interested in understanding the intricacies of GST, this blog post will provide valuable information and practical guidance.

What is cross-utilization of credits?

Cross utilization of credits refers to the practice of utilizing tax credits accumulated under one tax head to offset liabilities under another tax head within the framework of Goods and Services Tax (GST). In simpler terms, it allows businesses to apply the credit accumulated in one type of tax (such as CGST, SGST, or IGST) to pay off their tax liabilities in another category.

Under GST, taxes are levied at both the central and state levels. For instance, CGST (Central Goods and Services Tax) is imposed by the central government, while SGST (State Goods and Services Tax) is levied by the respective state governments. In cases involving inter-state transactions, Integrated Goods and Services Tax (IGST) is applicable.

The concept of cross utilization of credits allows businesses to offset the tax liability they owe under one tax head with the tax credit accumulated under a different tax head. This flexibility helps streamline tax payments and provides businesses with the opportunity to optimize their cash flow and manage their tax obligations more efficiently.

By cross-utilizing credits, businesses can reduce their tax burden and ensure that the taxes paid on inputs or goods/services are appropriately utilized across different tax categories. It enables businesses to make the most of the tax credits they have accumulated and avoid any unnecessary financial burdens.

It's important to note that cross utilization of credits is subject to certain conditions and guidelines set by the GST authorities. Businesses need to comply with the prescribed rules and maintain accurate records to ensure proper utilization of credits and adherence to GST regulations

What is Input Tax Credit in GST?

Input Tax Credit in GST or ITC under GST will be utilized as an efficient tool to eliminate the cascading effect of taxes. A supplier will be allowed to set off the tax he has already paid on the purchase of goods or services from the output tax while selling such goods. Thus, tax will be levied only on the value added by the previous supplier and hence avoid a tax on tax, i.e., double taxation.

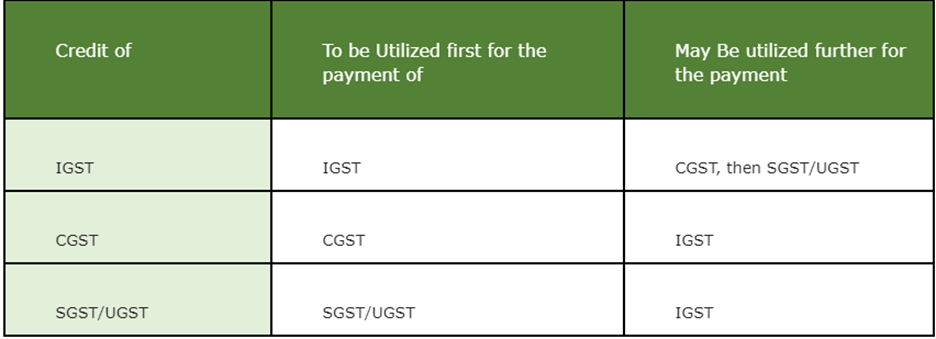

CBIC has clarified that IGST credit can be used for payment of all taxes. CGST credit can be used only for paying CGST or IGST. SGST credit can be used only for paying SGST or IGST.

What is Input Tax Credit (ITC) Reconcilciation a necessary step for GST filers?

The order of Input Tax Credit utilization in the GST regime shall be:

- The ITC on account of IGST would be allowed to be utilized for the payment of IGST, CGST, and SGST.

- The ITC on account of CGST would be allowed to be utilized for the payment of CGST and then for the payment of IGST. However, ITC of CGST would not be allowed to be used to adjust SGST.

- The ITC on account of SGST would be allowed to be utilized for the payment of SGST and then for the payment of IGST. However, ITC of SGST would not be allowed to be used to adjust CGST.

- In the case of Union Territory Goods and Services Tax (UTGST), the input tax credit can be utilized for payment of UTGST liability only after exhausting the input tax credit of IGST, CGST, and SGST.

- Set-off of Tax Liability: Once the input tax credit has been utilized as per the above order, if any tax liability remains, it should be paid in cash.

It's important to note that input tax credit can only be utilized for the payment of the same type of tax liability. For example, CGST input tax credit can be used to pay CGST liability, but it cannot be used to set off SGST liability.

Additionally, there are certain conditions and restrictions on the utilization of input tax credit, such as the requirement to have valid tax invoices, matching of input tax credit details with supplier's invoices, and GST compliance with other GST rules and regulations.

Businesses need to adhere to the prescribed order of input tax credit utilization to ensure compliance with GST laws and optimize their tax payments within the framework of the GST system.

The GST Model Law allows the cross utilization of credit of one component of tax against the other in various scenarios except in the case of utilization of ITC of CGST for SGST and vice versa.

It has been provisioned that the ITC entitlement, arising out of taxes paid under the Integrated Law will be allowed for utilization for the payment of taxes under the laws of the Centre, States or Union Territories. This has been done to ensure that ITC can be used effortlessly and smoothly for the payment of taxes under the Central and the State Law.

How Does the EaseMyGST GST software help for Utilization of Input Tax Credit?

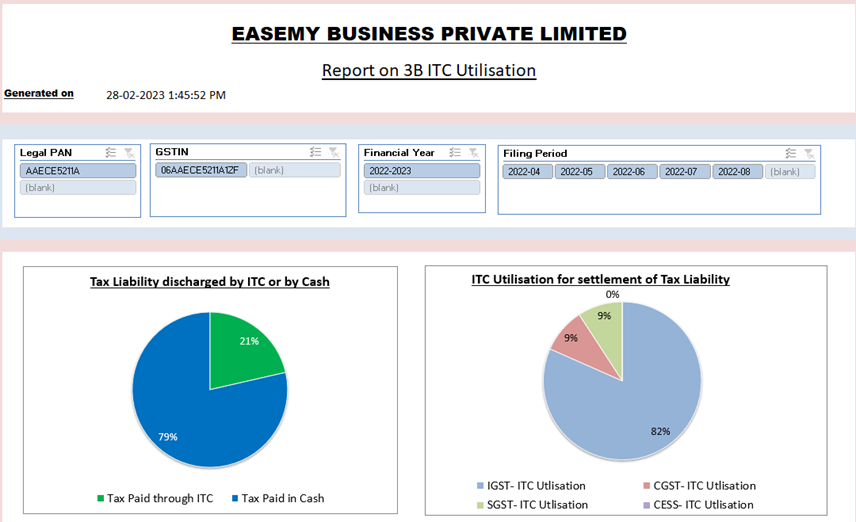

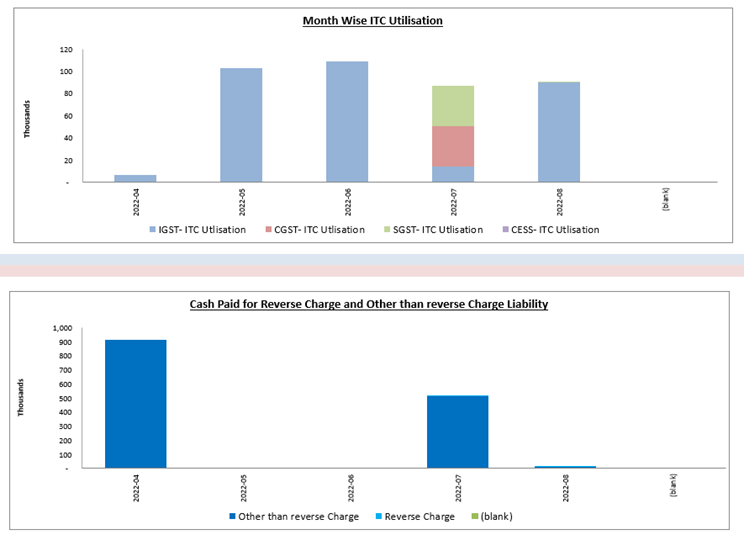

EaseMyGST has provided a dedicated report for ITC utilisation by comparison with GSTR 3B. This report will give you view of utilization of ITC. Here, you will get view based upon tax name wise i.e. IGST, CGST, SGST and Cess. Based on GSTR 3B, in this report you will get ITC utilized values against the various tax types.

Stay informed, stay compliant, and leverage the benefits of cross-utilization of credits and input tax credits in GST India to drive your business forward with Ginesys’ EaseMyGST, that makes GST filing hassle-free.