GSTR 3B vs GSTR 2A Inward Tax Comparison Report Benefits

Worried whether you have claimed correct ITC?

Have your supplier uploaded correct data on the GSTN?

Whether your credit claimed is higher or lower than what your vendor has uploaded? Connect with EasemyGST today to get answers to all your compliance-related worries.

We don’t just claim, we Deliver!

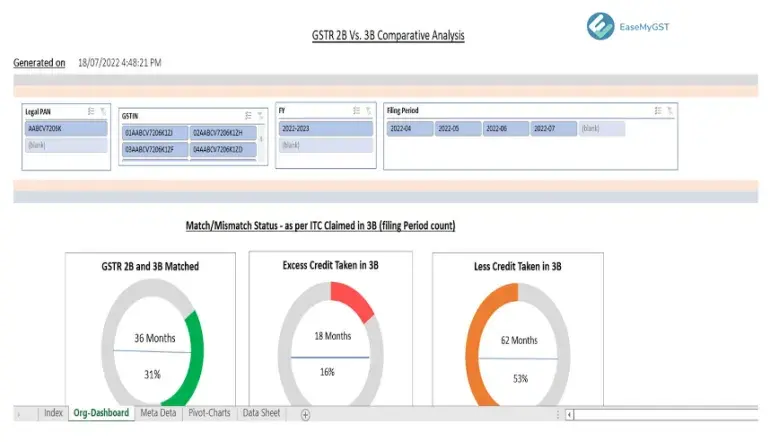

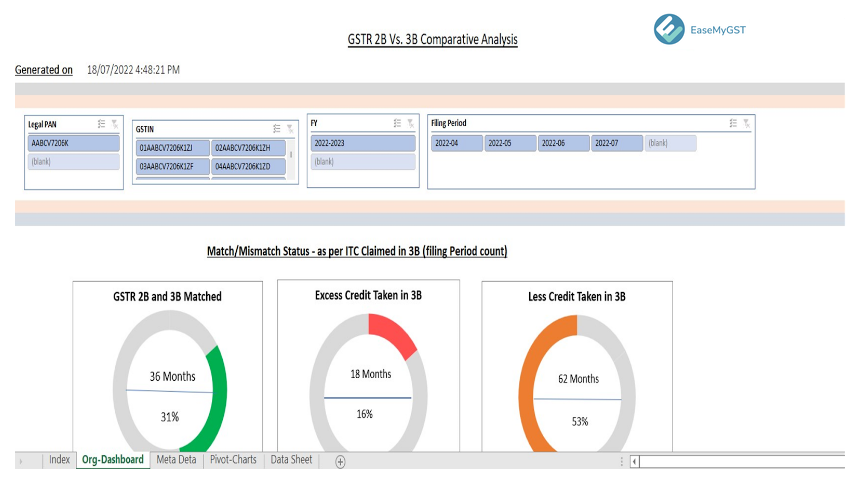

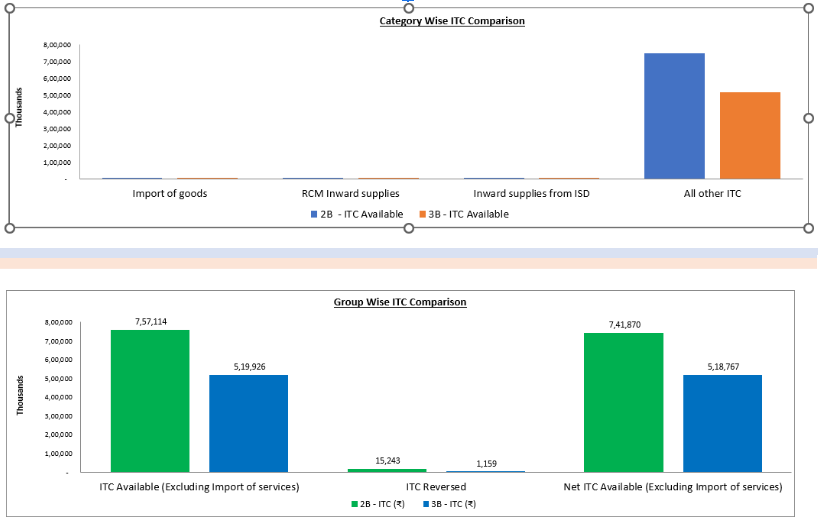

The inward comparison is a summary of GSTR 3B & GSTR 2A from the GSTN. This report helps you in:

1. Giving a true reflection of your Input Tax Credit – Whether the same has been excess claimed or short claimed in comparison to data as uploaded by Supplier

2. Ensuring that you claim your Credit Correctly and there is no scope of department litigation

3. Claiming your balance credit in case you have short claim your Input Tax Credit i.e., Your claim of eligible credit is lesser in comparison to taxes paid by your Vendor/Supplier.

4. Checking whether your claim of credit is correct, however, the supplier has not paid the taxes to the Govt.

5. Rectifying your mistakes before it is too late for the next filing.

6. Staying clear from any audit issues.

7. knowing if your vendors are filing returns on time and take a decision which vendor you want to consider dealing with.

8. you can also download the reports in excel/pdf file for record purpose, which shall also serve as an audit tool at the year-end. Review now before it’s too late! Start your free trial now.

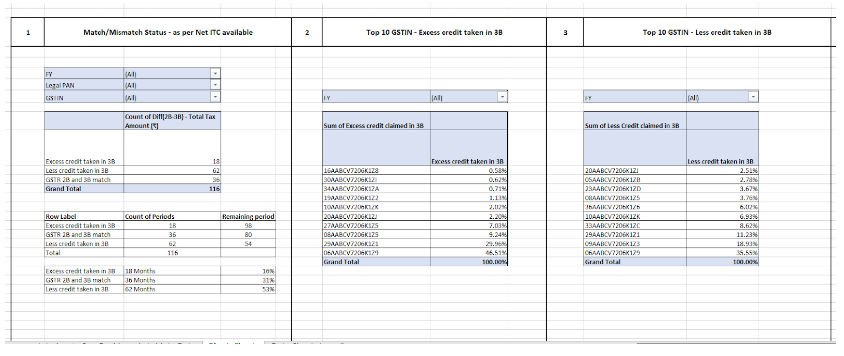

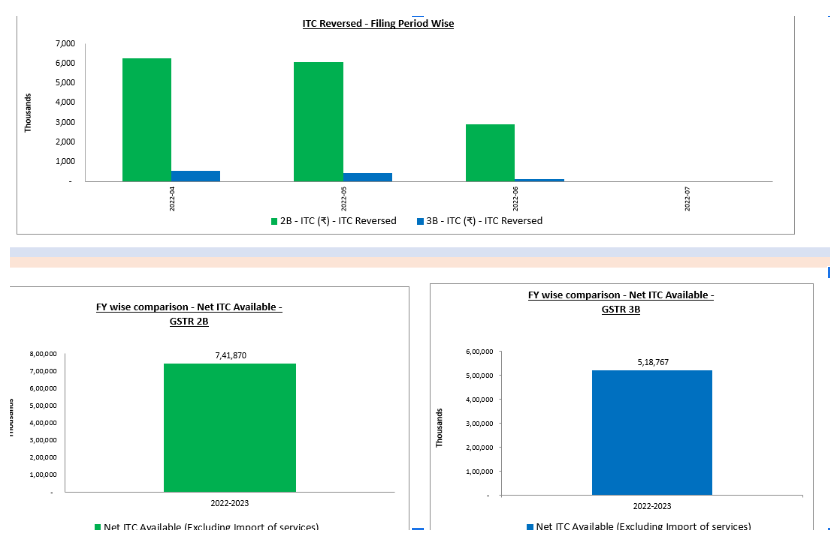

These are the base pivot charts on the basis of dash board is prepared.