How To Search GSTIN Details of Any Registered Taxpayer

The GSTN portal has introduced a new feature using which you can find important details related to a particular GSTIN.

Step-by-Step Guide:

Step 1: Go to https://services.gst.gov.in/services/login

Step 2: Click on ‘Search Taxpayer’

Step 3: Enter the GSTIN of the taxpayer you want to know the details of.

RESULT: When you search the GSTIN, you will receive some important details of the particular GSTIN:

- Legal name of the Business

- Date of Registration

- Type of Business

- The last 5 Returns filed by the business, along with the filing date.

EasemyGST – CA Assisted GST Compliance, powered by the finest GST Filing Software

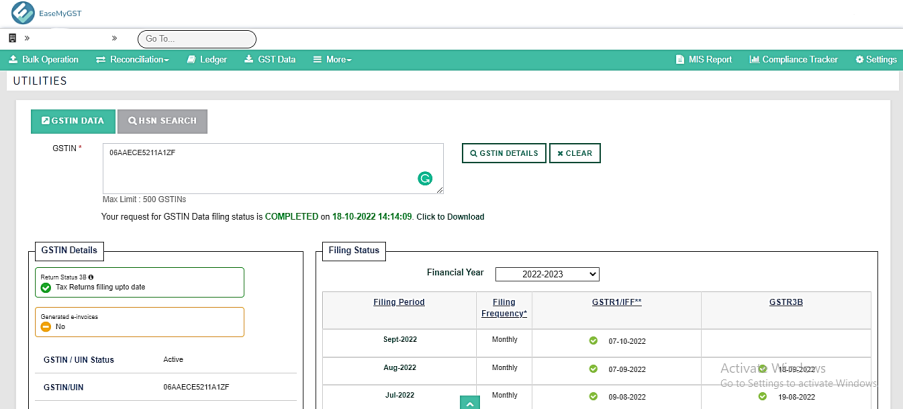

The EMG portal has introduced a feature using which you can find important details related to a particular GSTIN.

Step-by-Step Guide:

Step 1: Go to https://portal.easemygst.com.

Step 2: Login to EaseMyGST.

Step 3: Click on more utilities.

Step 4: Enter the GSTIN of the taxpayer you want to know the details. (You can find 500 GSTIN Details in a Single Click).

RESULT: When you search the GSTIN, you will receive some important details of the particular GSTIN:

- GSTIN Status (Active/ In-Active/ Cancelled).

- E-invoices Applicability (Yes/ No).

- Legal name of the Business.

- Trade name of the Business.

- Type of Taxpayer (Regular/ Composite).

- Filing Frequency. (Monthly/ Quarterly)

- Type of Business.

- Nature of Business.

- The FY Returns filed by the business, along with the filing date. (Filing Dates of GSTR1, GSTR3B, GSTR9, GSTR9C and Many More)

- Date of Registration.

- Address of the Business.

- Centre Jurisdiction of Business.

- State Jurisdiction of Business.

- Constitution of Business.

- Last Updated Time.

- If GSTIN is Cancelled then Date of Cancellation.

- Additional Place of Business.