Implementation of the requirement to mention HSN codes in GSTR-1

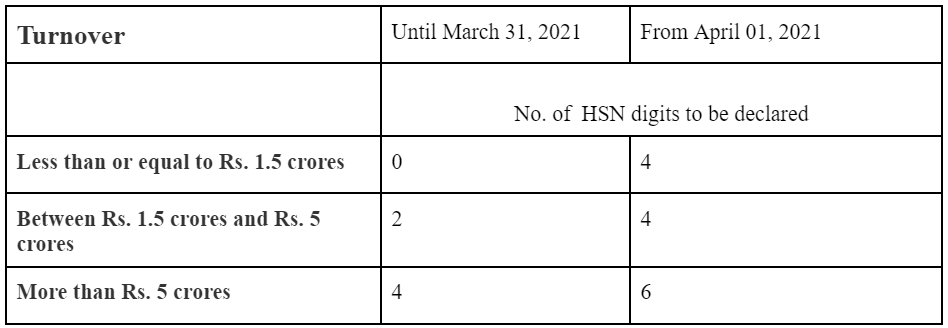

Depending on their Aggregate Annual Turnover (AATO) in the prior Financial Year, taxpayers are required to declare a least 4-digit or 6-digit HSN Code in table-12 of GSTR 1 in accordance with GST Notification No. 78/2020 - Central Tax, issued October 15, 2020. These modifications are being implemented gradually in order to benefit the taxpayers.

Phase 1 Parts I & II are already live on the GST Portal and went into effect on the first of April 2022 and the first of August 2022, respectively. Phase 2 will be implemented on the GST Portal as of November 1, 2022, and taxpayers with annual revenue up to Rs 5 crore would need to declare 4-digit HSN numbers in their GSTR-1.

Prior to GST Notification 78/2020, it is significant to remember that:

- Businesses who reported zero digit HSN codes had a maximum annual revenue of Rs. 1.5 crore.

- Businesses that reported 2 HSN figures had a revenue between Rs. 1.5 crore and Rs. 5 crore.

- Businesses that reported 4 HSN digits had a turnover of more than 5 crores.

Let's examine the new modifications in greater depth.

Phase 2

Taxpayers with AATO of up- to 5 cr.

Mandatory reporting of HSN at 4-digits

Taxpayers with AATO of more than 5 cr.

No change.

Taxpayers with AATO of up-to 5 cr

- Taxpayers could be required to mandatorily file 4-digit HSN codes.

- Manual access might be allowed for filling in HSN or description and in case of an incorrect HSN a caution or alert message can be shown. However, taxpayers will nevertheless be capable of documenting GSTR-1

Taxpayers with AATO of more than 5 cr.

To continue as it was.

The taxpayers are prompted to rectify the HSN points of interest where there's a blunder and a caution message is shown. However, it isn't obligatory approval for recording GSTR-1.

Advance stages would be actualized on GST Entrance without further ado and individual dates of usage and nature of altering would be overhauled from time to time.

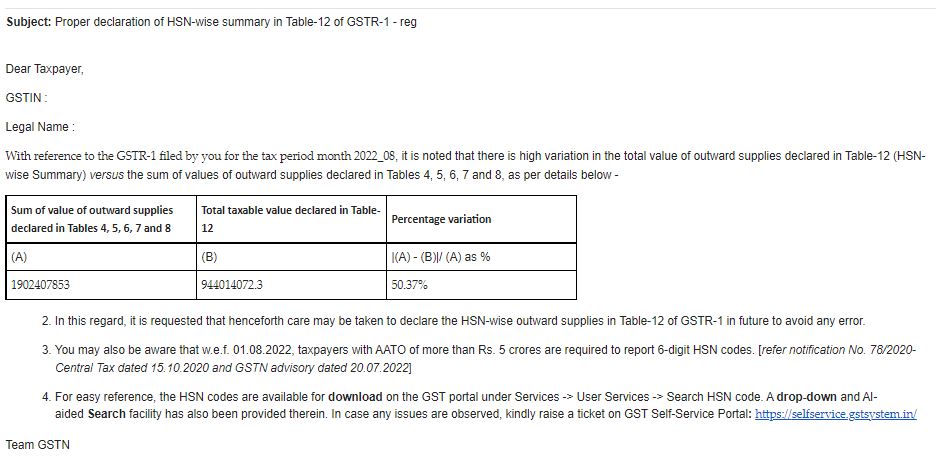

Example of how GSTN is sending notices and taking action for HSN mismatches:

Best software to reconcile GST data faster and ensure 100% compliance – EaseMyGST Software

As a registered taxpayer, reconciling your purchase invoices with the supplier-uploaded invoices on the GST system is a critical activity as it determines your ITC claim. Further, the Government issues legal notices to taxpayers for discrepancies in the ITC claimed in GSTR 3B and the amount as per supplier uploaded details. Our Smart Reconciliation comes in handy for managing reconciliation tasks in a timely, efficient and easy manner.

Feature Highlights:

Bulk Data upload facility – It'll assist you to transfer information for different GSTINs in one go

2P Summary – Gives an outline of transferred information. You can quickly check your uploaded data with the count of invoices getting considered for reconciliation

Bulk download of GSTR 2A – For different periods, you'll be able send ’Get GSTR 2A data’ ask in one go

Smart reconciliation – It auto-runs on your data and provides you the reconciliation results with summary

Advanced reconciliation – It makes a difference for you to amplify the scope of comparison between information that's within the supplier-only and purchaser-only categories. A few rules that offer assistance in way better compromise are :

- Checking invoices over the budgetary years

- Fuzzy invoice no. logic

- Checking exact values ignoring invoice number

- Checking invoices within the tolerance provided by you

Monthly reconciliation results with monthly GSTR 2A report – Makes a difference between you choosing month to month ITC and how much you'll claim as temporary ITC.

Net vendor summary – It gives you a look compromise status for each seller

PAN level reports and GSTIN level reports – It'll assist you to analyze in detail your purchaser-only and supplier-only invoices Send Mail – By utilizing this include you'll be able effectively to communicate errors to your merchant.