Key Reports For Managing GST Compliance

GST compliance and claiming GST inputs are key challenges for the tax personnel, accountants at any business these days in India. Having the right reports at hand will ensure that you are not filing a wrong return and getting the maximum GST inputs for your business.

These reports are designed to provide businesses with important information related to your tax liabilities, input tax credits, and overall compliance with GST regulations.

Reconciliation Summary Report

- This report shows the overall reconciliation result based on GSTR 2P and GSTR 2A/2B.

- Purpose and Scope: The user can get an overall financial year wise consolidated reconciliation summary for B2B supply including Credit note, ISD and Import section in one report.

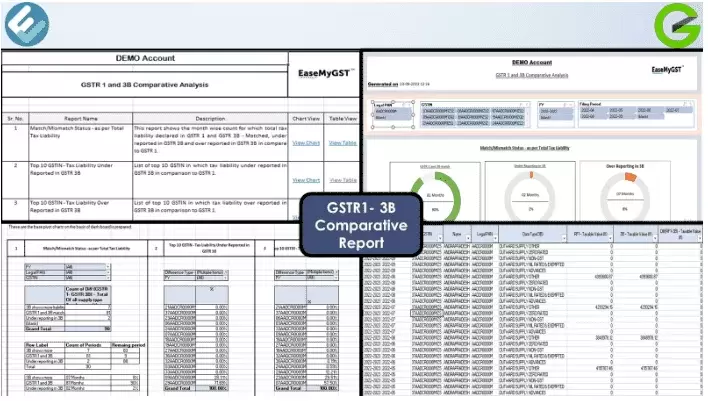

GSTR 1F - 3B Comparative Report

- Comparison of taxable value & tax amounts for filed GSTR 1 and GSTR 3B data. It includes the amendment effect.

- Purpose and Scope: This report will give you a cumulative comparative view for taxable values and tax amounts provided in GSTR 1 and GSTR 3B for outward supplies. So that by using this reports you can find out discrepancies in two returns i.e. GSTR 1 and GSTR 3B. And you can take corrective action for the same.

GSTR 2B - GSTR3B - Comparative Report

- Comparison of ITC available as per GSTR 2B and claimed in GSTR 3B.

- Purpose and Scope: This report will give you the total ITC details as per GSTR 2B and the total ITC as per GSTR 3B excluding ITC on import of services. The comparison is made month on month basis. Cumulative effect is not considered for this ,this report will help you to reconcile total ITC details between the GSTR 2B and GSTR 3B.

GSTR 3B - ITC - Cross Utilisation

- Usage of ITC across the tax heads for the filing period for a GSTIN.

- Purpose and Scope: This report will give you a view of utilization of ITC. Here you will get view based upon tax name wise i.e. IGST, CGST, SGST and Cess. Based on GSTR 3B, in this report you will get ITC utilized values against the various tax types.

GSTR 3B- Summary Report

- GSTR 3B detail for multiple GSTIN for multiple filing periods.

- Purpose and Scope: Here you will get the overall details of GSTR 3B in a tabular form. This report can help taxpayers get summary data for easy comparison with books of accounts and GST annual return.

GSTR 1 Summary Report : Section-wise

- Summary view of Sectional split up of Supplies as given in GSTR1 for multiple PAN/GSTIN and filing period.

- Purpose and Scope: So by using this report, you will get insight of section wise supplies and also based on section B2B and B2C, EXP you will get a view of how much you are supplying goods / services to registered counter parties, unregistered counter parties or exports made during the Year.

GSTR 1U – Tax Rate wise Classification of Outward Supplies

- Analysis of total outward supplies values based on tax rate slab as uploaded in IRIS Sapphire.

- Purpose and Scope: This report will give you an overview of outward supplies value on the basis of tax rate slabs. Here you will get a view based upon legal company name wise, GSTIN wise and Period wise.

GSTR 1F – Tax Rate wise Classification of Outward Supplies

- Analysis of total outward supplies values based on tax rate slab as field in GSTR 1.

- Purpose and Scope: This report will give you an overview of outward supplies value on the basis of tax rate slabs. Here you will get a view based upon legal company name wise, GSTIN wise and Period wise.

GSTR 3B-ITC-Classification

- Categorisation of ITC into imports, reverse charge and others for multiple GSTIN, multiple filing periods.

- Purpose and Scope: This report will give you a view of the categorisation of ITC available. Here you will get a view based upon Period wise, Legal company name wise and GSTIN wise. Based on GSTR 3B, in this report you will get input tax credit amount available against import of Goods/Services ,RCM inward supply and other ITC available.

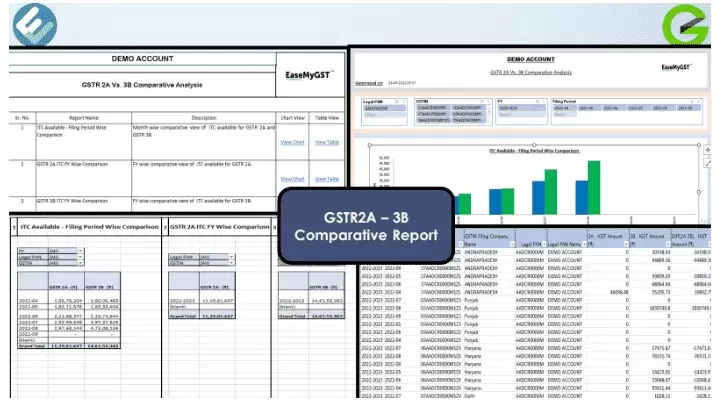

GSTR 2A – 3B Comparative Report

- This report will give you the details of all other ITC as per table 4(A)(5) of GSTR 3B and the total eligible ITC other than reverse charge as per GSTR 2A for multiple PAN/GSTIN and filing period wise.

- Purpose and Scope: There is one category in GSTR 3B i.e. ITC is available to others. So whatever the amount you mentioned for this category, your ITC details will be compared with GSTR 2A and the difference will be calculated for ITC other categories. These details will be available period wise. This report will help you to reconcile the total ITC details between GSTR 2A and GSTR 3B.

GSTR 1U - GSTR 3B Comparative Report

- Description of Report: Comparison of taxable value & tax amounts for GSTR 1 uploaded at IRIS Sapphire and GSTR 3B filed data. It includes the amendment effect.

- Purpose and Scope: This report will give you comparative view for taxable values and tax amounts provided in GSTR 1 and GSTR 3B for outward supplies.So that by using this reports you can find out discrepancies in two returns i.e. GSTR 1 and GSTR 3B. And you can take corrective action for the same.

GSTR 1F Invoice Level Report

- This report provides all GSTR 1 sections details at invoice level. It gives a complete overview of GSTR 1 filed.

- Purpose and Scope: Through this report outward supply details can be checked at invoice level.

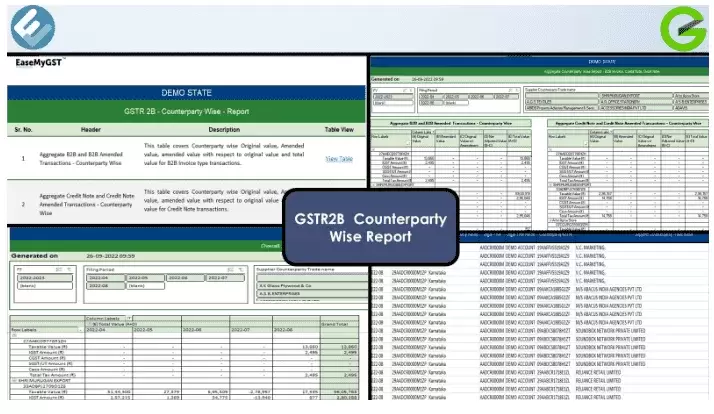

GSTR 2B Counterparty Wise Report

- This report will show the Counterparty wise details Taxable value and ITC. This Report is available for only one GSTIN for 24 filing periods.

- Purpose and Scope: This report will show the counter party wise transaction details showing in GSTR 2B.

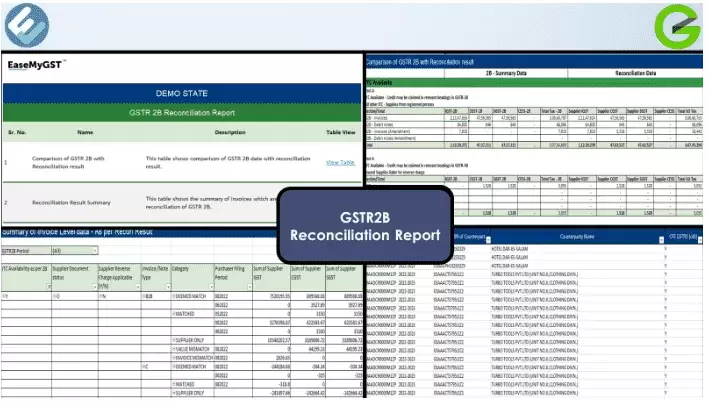

GSTR 2B Reconciliation Report

- This report will show the comparison between ITC as per GST 2B and ITC as per GSTR 2B reconciliation result. This Report is available for only one GSTIN one Filing Period.

- Purpose and Scope : This report will show the comparison between ITC as per GST 2B and ITC as per GSTR 2B reconciliation result. From this report users can get which invoices have been considered in reconciliation with GSTR 2B.

GSTR 2A ITC Analysis Report

- This report will provide a detailed report of Eligible and Non-eligible ITC including amendment effect.

- Purpose and Scope: Know the ITC Eligibility and In-eligibility based on the parameters of Place of Supply, Counterparty filing status (GST R1) and Reverse Charge. This report can be generated for multiple PAN, GSTIN and for two FY.

GSTR 2P Base Reconciliation Report

- This report will show the overall reconciliation result based on GSTR 2P.

- Purpose and Scope : This report reconciles GSTR 2P with GSTR 3B and GSTR 2B months. The user can identify the values for which GSTR 3B month is marked and not marked along with ITC availability as per GSTR 2B.

GSTR 1U - Division wise Sales Report

- Division code wise outward sales as uploaded in invoice level formats. Including amendments impact.

- Purpose and Scope: Based on GSTR-1 uploaded, this is a summary report providing division code wise concentration of sales.

GSTR 1U - Plant wise Sales Report

- Plant code wise outward sales as uploaded in invoice level formats. Including amendments impact.

- Purpose and Scope: Based on GSTR-1 uploaded, this is a summary report providing Plant code wise concentration of sales.

26 AS Report Based on GSTR 3B

- This report shows details of Turnover as per GSTR 3B filed, in the format of Table H of Form 26 AS.

- Purpose and Scope: Purpose of this report is providing GSTR 3B data for multiple months and multiple GSTIN in the format of part H of form 26 AS, so that users can easily compare the data with Form 26 AS.