Making GSTR 2B Reconciliation a Breeze with EaseMyGST

The government's stipulation that GST filers incorporate GSTR 2B data into their GSTR 3B emphasizes the significance of GSTR 2B for effective tax management and working capital optimization. This dependency underscores the importance of your vendors' timely and accurate GSTR 1 filings. To simplify and enhance this crucial reconciliation process, EaseMyGST offers a comprehensive solution.

Simplifying the GSTR 2B Reconciliation Process

For businesses with a limited number of registered purchases or B2B invoices, manually reconciling data in Excel by uploading GSTR 2B data from GSTN might seem straightforward. However, complexities arise when:

- you engage with multiple vendors,

- deal with a high volume of B2B invoices,

- manage multiple GSTINs or companies.

In such cases, adopting a professional approach through specialized GST software that reconciles purchases like EaseMyGST is recommended. EaseMyGST software offers a range of benefits:

1. Efficient Filing: Easily file GSTR-1, GSTR-3B, GSTR-9 or 9C, and ITC 4/6/7/8 with quick validation checks.

2. Vendor Filing Validation: Verify the filing status of your vendors or GSTINs to ensure compliance.

3. Advanced ITC Reconciliation: Utilize GSTR 2, GSTR 2A, and GSTR 2B data for comprehensive input tax credit (ITC) reconciliation.

4. Accurate GSTR 3B Preparation: Prepare GSTR 3B returns while aligning the data with GSTR 2B for precise tax reporting.

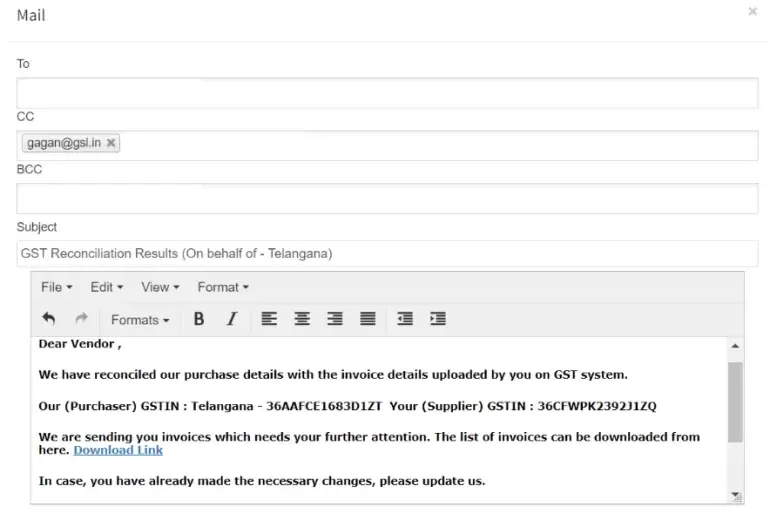

5. Communication with Vendors: Effortlessly communicate with vendors via email regarding any missing or mismatched invoices.

6. E-Invoice & E-Way Bill Reconciliation: Ensure accurate reporting by reconciling e-invoices and e-way bills with GSTR 1.

7. Automated GSTR 1 Preparation: Simplify GSTR 1 preparation using e-invoice data, streamlining the filing process.

8. User Management System: Collaborate seamlessly with a multi-user system and role-based access management.

9. Dedicated Support: Benefit from real-time assistance from a dedicated account manager.

10. Latest Updates: Explore additional features including PAN-level 2A reconciliation, comment filtering in reconciliation results, user-specific custom download settings, and identification of structural errors in uploaded files for GSTR1, GSTR2, GSTR6, and ITC04.

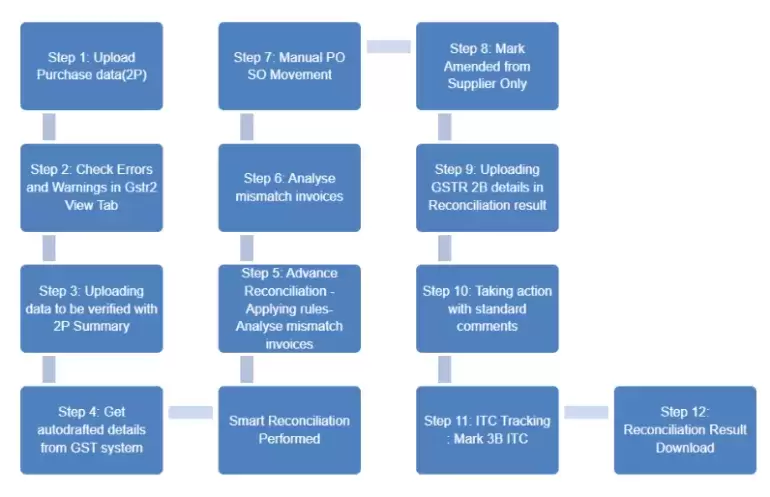

Executing GSTR 2B Reconciliation in EaseMyGST

By leveraging the GSTR 2B reconciliation feature of EaseMyGST, businesses can break down their purchase invoices, identifying matches, missing invoices, and discrepancies. This software offers a variety of result categories and allows users to apply advanced logic while customizing tolerance levels for tax amount reconciliation. With its cumulative view, dedicated missing invoices section, and mail options featuring data download links, EaseMyGST streamlines the GSTR 2B reconciliation process.

Here is a summarized guide to performing GSTR 2B reconciliation using EaseMyGST:

1. Data Import: Import GSTR 2B data into EaseMyGST software.

2. Comparison Rules: Utilize various reconciliation rules and logic options for matching, mismatched, and missing invoices.

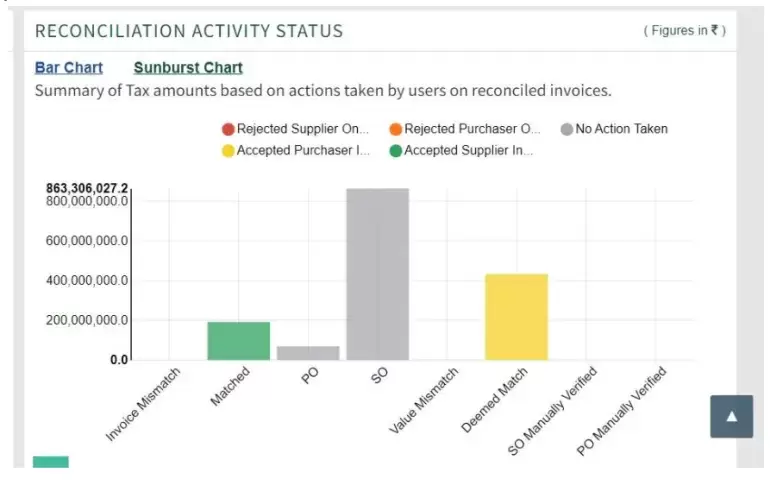

3. Accept / Reject Actions & Remarks: Take predefined actions such as accepting supplier details or rejecting invoices. Add remarks for reference.

4. Review Process: Review reconciliation output, categorized as match, value mismatch, invoice mismatch, supplier only, purchaser only, and more.

5. Advanced Reconciliation Logic: Apply advanced logic options like financial year-spanning reconciliation and fuzzy logic on invoice numbers.

6. Easy Workbench: Utilize a user-friendly workbench with filter options for efficient reconciliation.

7. Dedicated Missing Invoices Section: Access a separate section for missing invoices to streamline actions.

8. Mail Vendors with Data: Email vendors using the software, attaching data download links for effective communication.

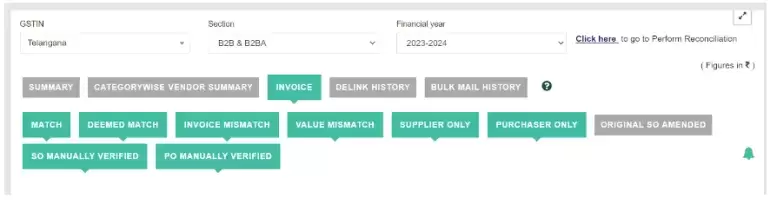

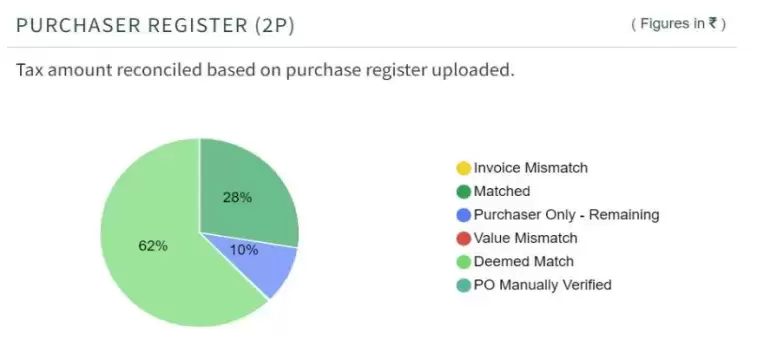

Output of the GSTR 2B Reconciliation Process in EaseMyGST

Once the GSTR 2B reconciliation is done, it is clear which purchase invoices are matching with the vendor’s inputs and which are not matching, and also which invoices are missing.

You can see below EaseMyGST gives a simple snapshot of the reconciliation output with clearly segregated invoices

Matched Invoices:- Details in invoices are matching

Value Mismatch:- Difference in one or more value-related fields in the invoices, including at least one of the taxable or tax values.

Invoice mismatch:- Difference in invoice fields, which are other than taxable value and tax values, includes pos, reverse change, invoice type and invoice value.

Supplier only:- Invoices uploaded by the supplier for which no corresponding invoices were found in your data.

Purchaser Only:- Invoices uploaded by you for which no corresponding no corresponding invoices were uploaded by the supplier (GSTR-2A)

Original supplier only amended:- Original invoices in the GSTR2A B2B section which are already amended by the supplier in the GSTR 2A B2BA section, hence to be ignored.

Enhancing GSTR 2B Reconciliation with EaseMyGST

EaseMyGST empowers businesses to navigate complex GSTR 2B reconciliation scenarios with ease. The software offers comprehensive insights into invoice matching, allowing users to differentiate between various reconciliation outcomes such as matches, value mismatches, and more.

With a simplified user interface, advanced reconciliation logic, and seamless communication features, EaseMyGST revolutionizes GSTR 2B reconciliation. Businesses can confidently identify matches, address discrepancies, and enhance their tax management strategies using this dynamic software.