Streamlining GST Annual Returns GSTR 9 & 9C with EaseMyGST

Managing and filing GST returns can be a daunting task for businesses. Among the numerous returns required, GSTR 9 and GSTR 9C hold particular significance due to their comprehensive nature. EaseMyGST, a leading GST solutions provider from Ginesys, has stepped up to simplify this process, ensuring accurate and efficient filing of annual returns. Let's delve into the details of GSTR 9 and GSTR 9C, and how EaseMyGST is facilitating their seamless completion.

Understanding GSTR 9 Annual Returns

GSTR-9, an annual return mandated by the government, consolidates the information furnished in monthly or quarterly returns like GSTR 1, GSTR 2A, and GSTR 3B. This return encompasses crucial details such as purchases, sales, input tax credits, refunds, and more. It serves as a summarized overview of a taxpayer's entire financial year activities.

Eligibility and Exemptions for the returns

All registered taxpayers under GST are required to file GSTR 9, except for those opting for the composition scheme, casual taxable individuals, input service distributors, non-resident taxable persons, and those paying TDS under Section 51 of the CGST Act. Moreover, businesses with an annual turnover of up to Rs 2 crore have the option to skip GSTR 9 filing from FY 17-18 onwards.

Components of GSTR 9

GSTR 9 consists of various components, including details of taxable supplies, input tax credits claimed, tax paid, demands and refunds, and more. Notably, if a taxable person possesses multiple GSTINs under the same PAN, separate annual returns must be submitted for each GSTIN.

Deadline and Late Fees

The deadline for filing GSTR 9 is usually December 31st of the year following the relevant financial year, unless extended by CBIC. Late filing incurs a fee of ₹200 (₹100 CGST + ₹100 UT/SGST) per day, capped at 0.50% of the turnover.

GSTR 9C: The Reconciliation Statement

GSTR 9C serves as a reconciliation statement between the annual return (GSTR 9) and the audited annual financial statements of the taxpayer. This statement showcases the alignment of figures from the books of accounts and those reported in GST returns throughout the financial year. Businesses with an aggregate turnover exceeding ₹5 crore are mandated to submit GSTR 9C.

Applicability and Due Date of GSTR 9C

GSTR 9C applies to registered taxpayers with a total turnover surpassing ₹5 crore in a financial year. It must be self-certified by the taxpayer on the GST portal and is essential for those who require annual accounts audits under GST laws. The deadline for GSTR 9C mirrors that of GSTR 9 – December 31st of the following year.

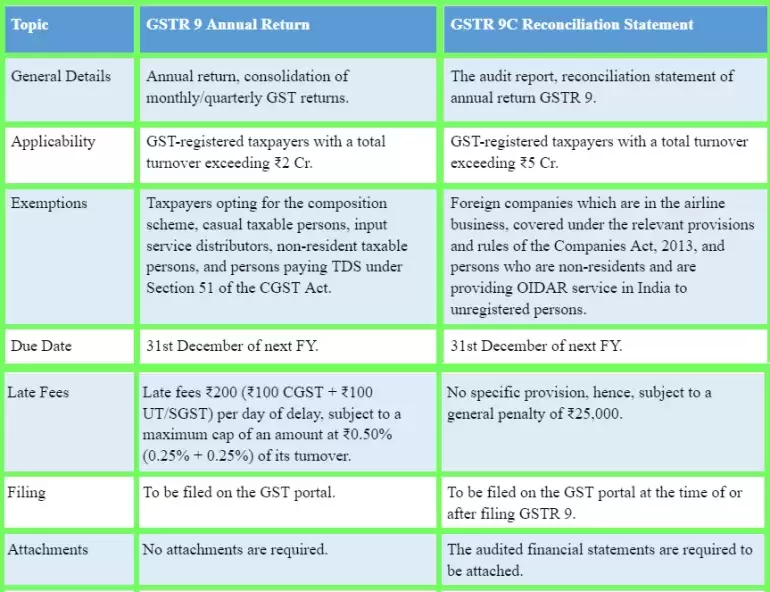

Comparing GSTR 9 and GSTR 9C

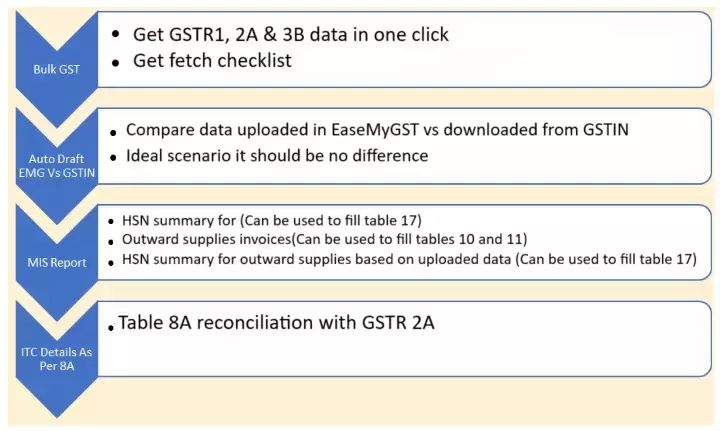

What steps need to be followed in EaseMyGST for annual returns ?

Leveraging EaseMyGST for Hassle-Free Filing of Annual GST returns

EaseMyGST offers an all-encompassing solution for GST returns, including the complex GSTR 9 and GSTR 9C. Its features streamline the filing process and minimize errors:

Data Compilation: Easily access and download GSTR-1, 2A, 3B, and 9 data for the entire financial year.

Automated Fillings: Automatically populate GSTR-9 tables using data from GSTR-3B, 1, and 9, simplifying fields like 4, 5, 6, 8, 9, 10, 11, and 17.

Reconciliation: Facilitate reconciliation of tables like 8A and 2A, ensuring accuracy in reporting.

MIS Reports: Generate insightful reports comparing GSTR-3B with 2A and 1, aiding in discrepancy identification.

Integration: Seamlessly import data through Ginesys Integration, enhancing efficiency.

HSN Summary: Calculate outward HSN summary directly from sales books to fill Table-17.

Invoice-Level Reconciliation: Align GSTR-1 data with bookkeeping records at the invoice level.

Why is EasyMyGST the best GST software for GSTR 9 and 9C ?

Data compilation: Single click download of GSTR-1, 2A, 3B, and 9 for the entire financial year from GSTN.

Automated Fillings: The software auto-fills GSTR-9 tables using data from GSTR-3B, 1, and 9.

Reconciliation: Reconcile Table 8A and 2A discrepancies to ensure accurate reporting.

Reports: Generate comprehensive reports in a few clicks for informed decision-making.

Integration with Ginesys ERP and other ERPs: Import data seamlessly via Ginesys Integration for enhanced efficiency. Get your ERP integration with EaseMyGST done in a few days.

HSN Summary: Automatically compute the outward HSN summary for Table-17.

Invoice-Level Reconciliation: Align GSTR-1 data with accounting records at the invoice level.

In conclusion, GSTR 9 and GSTR 9C are critical components of GST compliance, demanding accuracy and meticulousness. EaseMyGST steps in as a reliable partner, simplifying the complexities and reducing the burden of filing these returns. By automating data compilation, reconciliation, and reporting, EaseMyGST ensures a seamless experience, empowering businesses to meet their GST obligations efficiently and effectively.