Vendor Communication Through GST Software | EaseMyGST

Since the beginning of GST, vendor communication has been an important aspect in ensuring that missing invoices not coming in 2A/2B should be informed on time to the vendor.

Clients usually use the e-mail & Excel option to communicate but tracking the old mail & reconciling with vendors is always a difficult task. But in EaseMyGST, India’s premier GST compliance app) in both modules (E-DOCs / GST returns), clients can directly communicate with vendors via a dedicated mail option with in-depth message reporting.

How to communicate with vendors in the EaseMyGST GST Module?

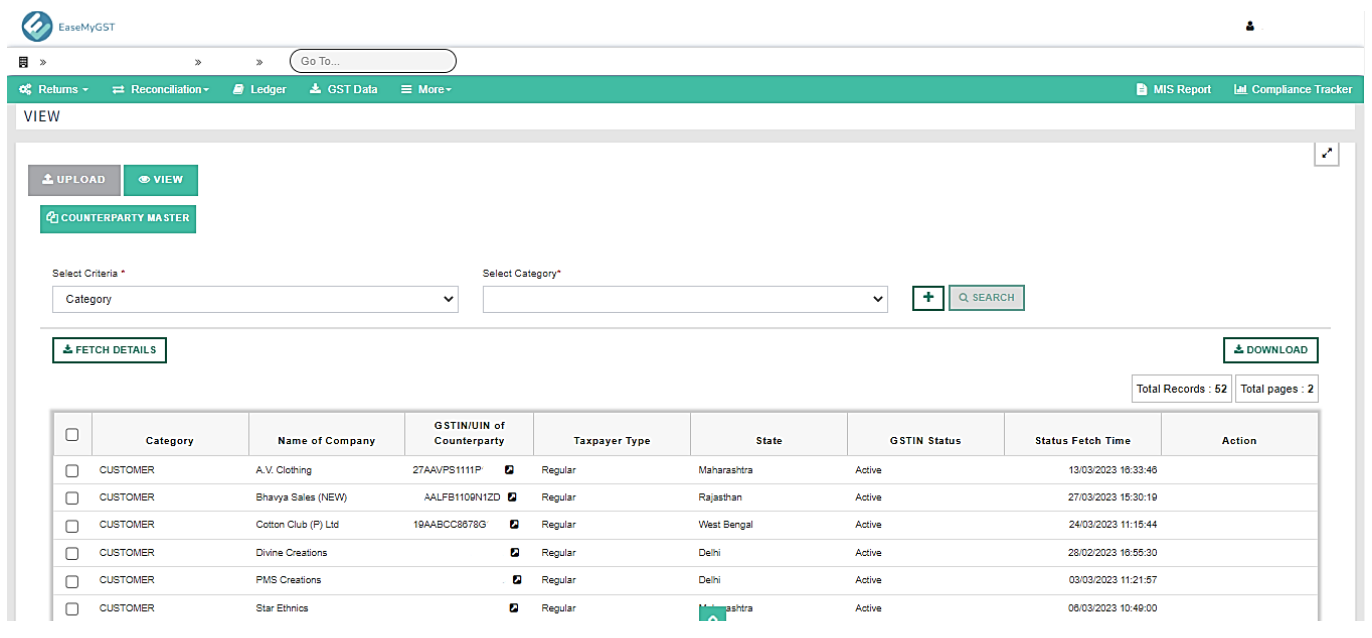

Vendor Master – We have a dedicated Vendor master where the user can upload his entire vendor data through a single upload using a simple Excel template.

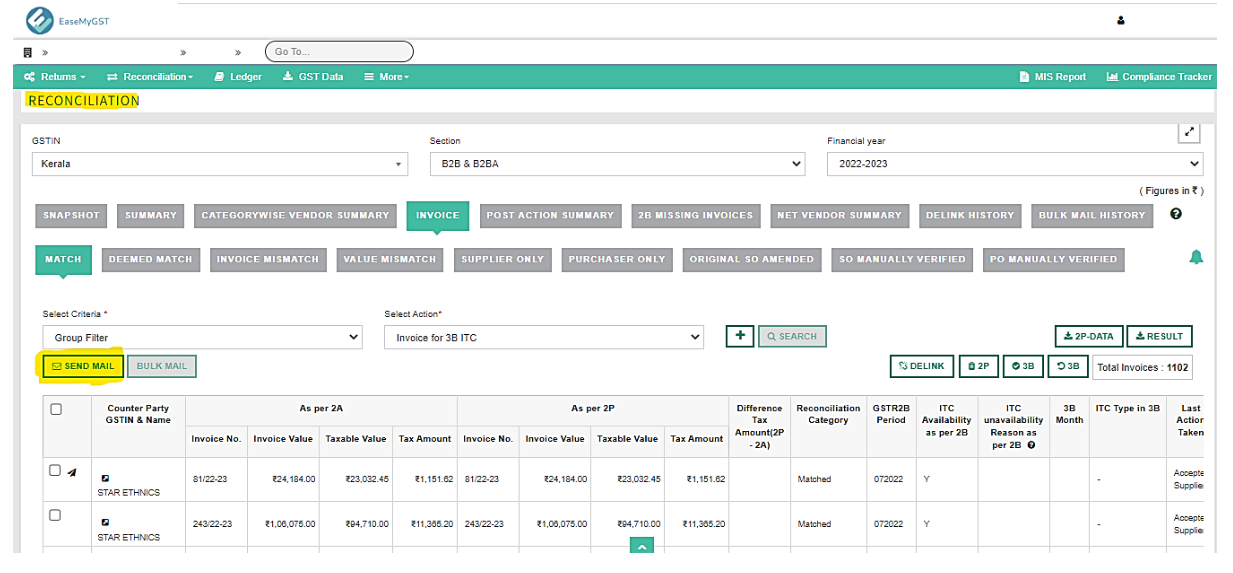

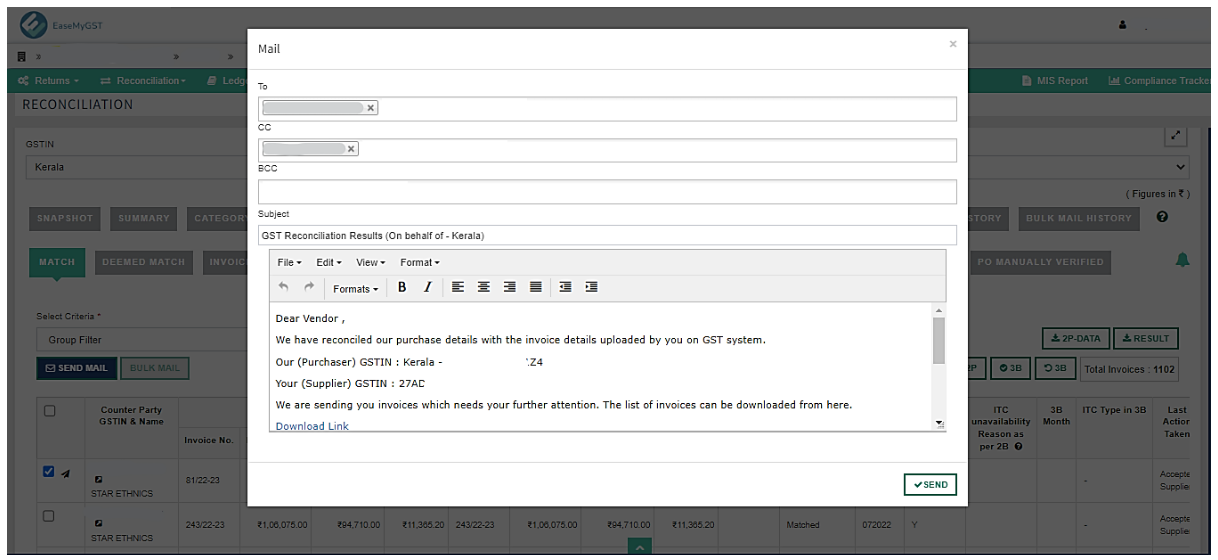

Mail In Reconciliation – On click of Send Mail button after selecting single/multiple records of a single counterparty, a Compose window will appear with auto-filled email addresses (which are present in the Vendor master for the selected counterparty).

How to communicate with vendors in the EaseMyGST E-Document Module?

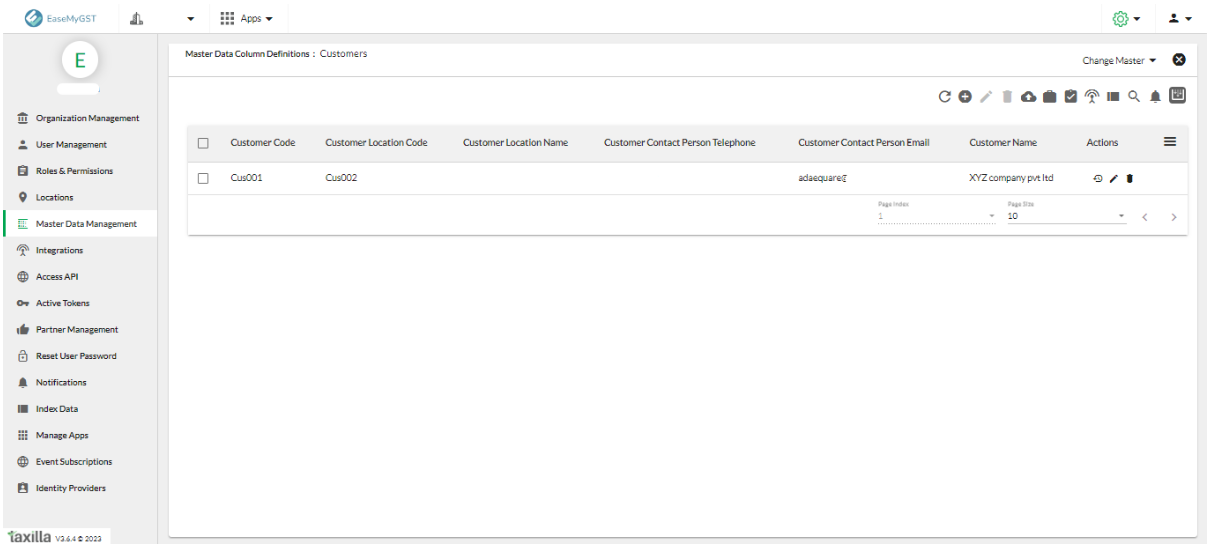

Customer Master – We have a dedicated Customer Master where user can upload his entire Customer data through a single Excel upload following a simple template.

Mail In E-invoicing – While making the E-invoices the Direct E-invoice PDF will be mailed to the customer or vendor for whom the E-invoice has been made.

To know more in detail, you can connect with the EaseMyGST team through the contact us page.